What we do

Software

as a Service

Launch liquidity while retaining full control. With a fixed service fee structure, your trading results and liquidity remain fully yours.

-

01

API-Key Market Making Model

Rely on a six-year track record of market making and software across many markets. We have refined our algorithms, order book design, and liquidity strategies through our proprietary API-key model.

Order Book Management

We engineer order books that go beyond filling the spread. Depth is purpose-built, aligning liquidity placement with your available capital to meet KPIs and reduce slippage.

Flexible Capital

We give you the ability to scale liquidity on your terms. Capital can be added or withdrawn and strategies are recalibrated to match. Avoids lockups while preserving both transparency and efficiency.

-

02

Delta-Neutral Market Making Model

Our proven foundation model evolves into a delta neutral system that neutralizes directional risk. The result is deep order books supported by hedged inventory, with all value retained by you.

Advanced Arbitrage and Hedging

Capture volatility across multiple markets with strategies normally reserved for proprietary trading firms and market makers. Provide resilient liquidity that thrives in market swings.

Deep Liquidity Provision

Through delta neutral execution, we offset exposures across markets to safeguard capital. This keeps markets liquid, spreads tight, and market depth reliable for traders.

Standalone

Services

Independent implementation with the same reliability as our full models.

-

Software & OTC Trading

We provide CEX and DEX implementation for token issuers and venture capital funds. With industry best practices we avoid signaling to minimize market impact.

-

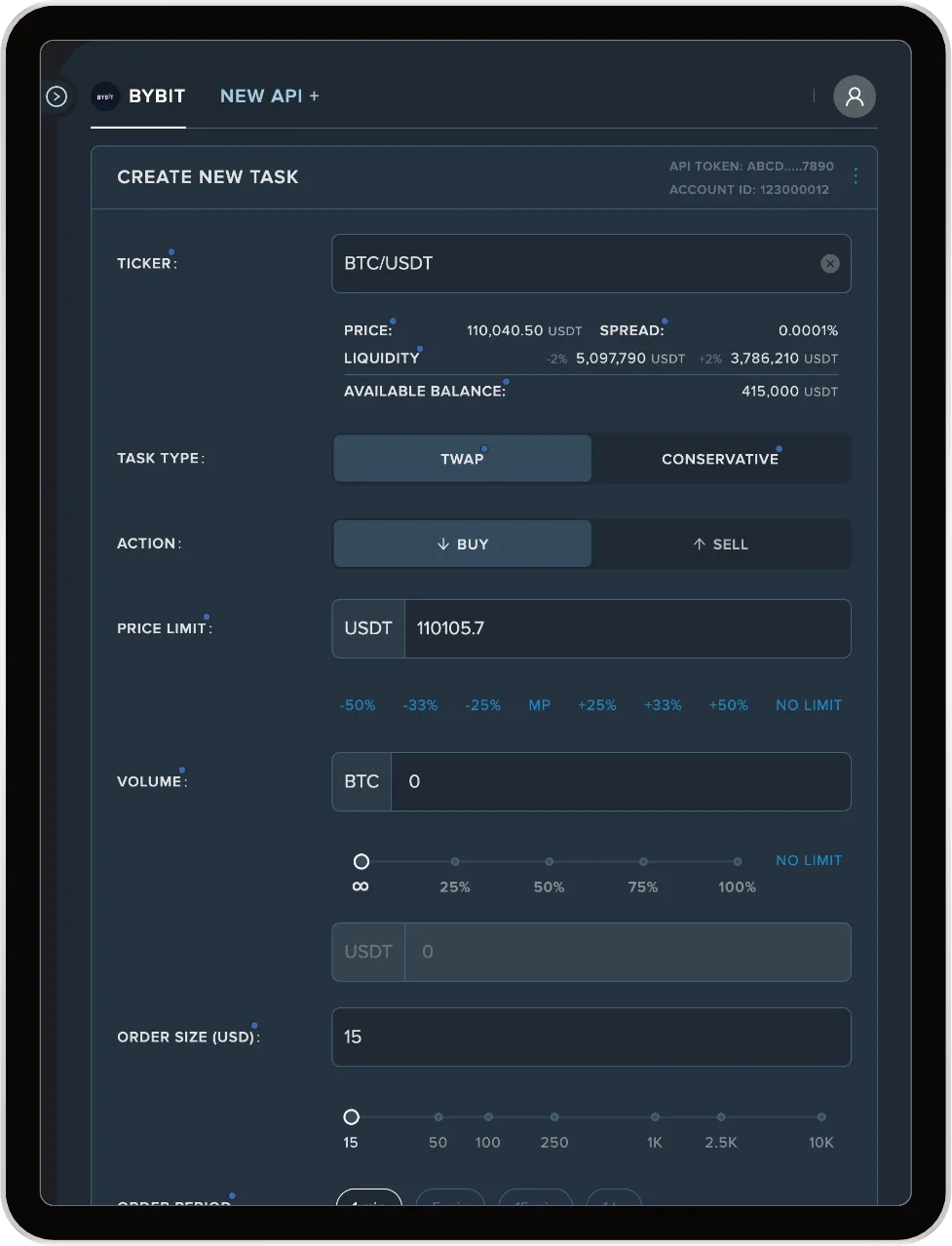

Self-Service Terminal

Our self-service terminal lets you deploy strategies in real time with full control, in a trustless manner (e.g., transactions are verified by code, not people; there is no central authority; outcomes are independently verifiable). You set the parameters. Our infrastructure ensures speed and stability.

-

Curated Access to Key Connections

We connect you with the right partners at the right time, from listings and funds to long-term strategic allies. Alongside implementation, we provide advisory support and curated introductions that strengthen your position in the market.

Show, Don't tell

Live Dashboards

And Support

Real-time visibility and responsive support team

We provide dashboards that give real-time visibility into liquidity operations across markets.

You can track order book depth, spreads, volumes, and capital deployment as they happen.

This ensures transparency and dependable support at every stage.

Resilient Infrastructure

Technology

-

01Regional InfrastructureLow latency servers strategically deployed in every key region.

-

02Sub-Millisecond ExecutionUltra-fast execution architecture for optimal trade performance.

-

03Operational SafeguardsPer market limits and throttles to protect allocated inventory.

-

04MEV-Aware, Multi-ChainDEX routing with slippage bounds across major chains and rollups.

Interoperability

Integrated across

multiple exchanges

60+ CEXs, 10+ VMs and 20+ DEXs

Testimonials

Lars Seier Christensen

Co-Founder Saxo Bank

I'm backing Skynet Trading because of their proven track record of delivering value to their partners and driving innovation in the crypto industry through numerous market cycles.

Yawn Rong

Co-Founder Stepn

We're very satisfied by the services and trading strategies that Skynet Trading has been delivering for FSL. They helped us in our go-to-market strategy and we would recommend their services.

Jesse Eisses

Co-Founder Nosana

Skynet was a key partner providing essential stability for Nosana. Critically, they scaled their support seamlessly when we found product-market fit and activity surged, proving invaluable in both downturns and high-growth phases.